When your Annual Statement from your superannuation fund arrives it may be tempting to put it straight into the drawer. Your superannuation is either already your most valuable asset, or will be by the time you reach retirement age.

When your Annual Statement from your superannuation fund arrives it may be tempting to put it straight into the drawer. Your superannuation is either already your most valuable asset, or will be by the time you reach retirement age.

Your details

Firstly, make sure your details are up to date – your name, address, other contact details & your Tax File Number (TFN). If your superannuation fund doesn’t have a record of your TFN, you may pay a higher rate of tax on your contributions.

Beneficiaries

Check your beneficiary and update them if needed. A super fund may offer different types of nominations.

- Non-binding nomination – You may direct the Trustee to whom your benefit is paid to, but the Trustees have the final decision. They will take into account all claimants and check your will.

- Binding nomination (lapsing) – The Trustees are bound to pay your benefit to who you have nominated, providing you renew every 3 years.

- Binding nomination (non-lapsing) – The Trustees are bound to pay your benefit to who you have nominated, however you do not need to renew every 3 years.

Under Superannuation Law, the person(s) you nominate can only be a spouse (including defacto), Child (including adult children, step and adopted children), Financial dependent, or someone in an interdependent relationship with you at the time of your death. Otherwise you can make the nomination to your estate (and ensure your will is up to date).

Insurance

Review your insurance cover. Is your level of cover still appropriate? Do you need to increase your cover to take into account a change in your income or commitments?

The most common types are Death only, Death and Total & Permanent Disablement (TPD), and Income Protection. Some also offer Trauma cover. The type of cover could either be:

- Automatic insurance cover – This is a minimum level of cover without filling in forms.

- Units – The value of each unit depends on your age (decreases as you get older) and the premiums remain the same. You can increase the number of units you have.

- Fixed – The level of insurance cover remains the same and the premiums increase as you get older.

Investment Strategy

Does your investment strategy still suit your risk profile? Your investment strategy should match your long term investment goals. If you are considering an investment switch, it may be best to speak to a Financial Planner to explain the implications of your decision.

Fees

What are you paying fees for and how much are you paying? Do the fees include financial advice or is that extra?

What about multiple super funds from previous employers? Or do you have lost super because you changed your name or address. If you have more than one fund, then each super fund will be charging you fees. Most super funds can provide you with a “Combine your super form” which you will need to complete for each fund you want to rollover into to your existing super fund.

Employer Contributions

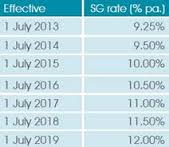

Have a look at your super contributions. Are they up to date? You can check your payroll slips and make sure that the amount being paid is the same as what is going in. Superannuation Guarantee (SG) Contributions commenced from 1 July 1992. At that time, employers either paid 3% or 4% (depending on total amount of payroll) of your gross salary into your super account. Since then the rate has gone up steadily. It was sitting at 9% for a while, but from 1 July 2013, employers need to pay 9.25%. Under legislation, your employer must pay at least quarterly. If not, follow up with your payroll office.

Generally, you’re entitled to super guarantee contributions from an employer if you’re 18 years old or over and paid $450 or more (before tax) in a month. It doesn’t matter whether you’re full time, part-time or casual or a temporary resident of Australia. If you’re under 18 you must also work more than 30 hours per week to be entitled to super contributions. If you’re a contractor paid wholly or principally for your labour, you’re considered an employee for super purposed and entitiled to super guarantee contributions under the same rules as employees.

From January 2014, your employer will pay into a “MySuper” authorised account if you do not choose a super fund. If you are eligible to choose a fund, your employer must give you a standard choice form.

If your employer forwards member voluntary contributions into your super fund on your behalf, they must be paid into your super fund with 28 days of the end of the month in which they take it from your pay.

Add extra contributions to your super

Adding extra to your super early in your working life means that compounding interest will help your balance grow. Your employer contributions will probably not be enough to ensure your final balance is enough for retirement. There are several ways to add extra to your super:

Concessional (before-tax) contribution

Known as Salary Sacrifice. You sacrifice part of your salary for extra employer contributions which are then taxed at 15% instead of your normal tax rate.

The general concessional (before tax) contributions cap for 2013-14 is $25,000.

However, from 1 July 2013 if you are 59 years old or over on 30 June 2013, additional concessional contributions will be able to be made to your super, with the cap increasing from $25,000 to $35,000.

From 1 July 2014, the higher cap of $35,000 will also apply to people who are 50 years or over.

Non-Concessional (after-tax) contribution

Also known as a personal contribution. You can make a personal contribution to your super (even if you are not working) as long as you are under 65 years of age. If you are age 65 -75 you can only make a personal contribution of you satisfy the work test.

The non-concessional contributions cap for 2013–14 is $150,000. If you are under 65 years old for at least one day of a financial year, you can ‘bring forward’ two years’ worth of contributions, giving you a total non-concessional contributions cap of $450,000 for the three years, rather than a $150,000 cap in each year of the three years.

This may enable you to:

- Claim a Tax deduction if you are self-employed, up to $25,000 per year.

- If you’re a low-to-middle income earner, the government could help boost your super savings through the super co-contribution and the low income super contribution. However, if you claim a deduction for all of your personal contributions, you won’t be eligible for a super co-contribution.

Spouse contribution

A tax offset may apply to a spouse if a spouse makes a contribution to a non-working or low-income-earning spouse super fund, whether married or de facto.

The spouse may be able to claim an 18% tax offset on super contributions of up to $3,000. The maximum tax offset is up to $540 each financial year.

Breast Cancer

/in Personal Risk Financial Advice /by Fil-BattistiOctober marked Breast Cancer awareness month around the world. Breast cancer is the most commonly diagnosed cancer among women in Australia, with 14,940 women predicted to be diagnosed with the disease in 2013, rising to 17,210 women in 2020. That’s an average of 330 women a week.

In the last five years, breast cancer has made up 50% of all of trauma insurance claims paid to women. And a high prevalence isn’t just observed for trauma. Breast cancer accounted for 20% of income protection claims, 18% of TPD claims and 15% of life and terminal illness claims.

Increasing age is one of the strongest risk factors for developing breast cancer, but it doesn’t just affect older people. Two out of three cases will be diagnosed in women aged 40-69, key ages for insurance coverage.

How can insurance help?

Trauma cover can provide a lump sum payment in the event of diagnosis. You can discuss with us how much cover is needed and you may include funds for treatment, supplementary income, reducing debt or even for a spouse to take time off work. Given the high chance of claim, trauma is the most expensive of the lump sum covers available.

Trauma insurance can cover breast cancer diagnosed at any stage. Definitions have evolved in the last few years to provide full claims to most women, even if they are diagnosed early, referred to as carcinoma in situ. Modern definitions should cover women who have a lumpectomy and follow up treatment like radiation or chemotherapy, rather than requiring more dramatic treatment to satisfy a claim at an early stage.

Keeping life going

Of course not all women will cease work. Australian women have an 89% chance of surviving more than five years after diagnosis. Certain income protection definitions and benefits can help provide support.

Cancer patients are one of the most likely groups of claimants to continue working through treatment. Finding a policy with a 10 hour definition will give them the flexibility to work up to 10 hours a week while undergoing treatment, without financial penalty. You may also look for a policy with a counselling benefit. While grief support is common on life cover, under income protection, this benefit gives access to support and comfort during a difficult and stressful time.

There are lots of considerations when choosing a policy for cancer coverage and sometimes it is impossible to be across all the benefits.

To find out how trauma insurance can help you, contact our office today!

1,3, 4. www.nbcf.org.au/Research/About-Breast-Cancer.aspx

2. Claims paid between 2009 and August 2013

Investing for your Children’s Future

/in Financial Advice General Info /by Fil BattistiThe first step is to clearly identify why you are investing, then set yourself a goal and put a strategy in place to achieve that goal. Your strategy needs to suit your circumstances, risk tolerance and investment timeframe.

Whether you have short-term goals and want a high interest earning savings fund or you have long-term goals with a focus on managed funds, one vital question you need to consider is ‘Whose name should the investment be held in?’

Children are taxed at penalty rates on unearned income.

There are other tax-effective investment options available including:

As there are a number of options to choose from, make an appointment with us today to determine the right choice for you and your children.

Source | IOOF

Super Check-up

/in Financial Advice General Info /by Fil BattistiYour details

Firstly, make sure your details are up to date – your name, address, other contact details & your Tax File Number (TFN). If your superannuation fund doesn’t have a record of your TFN, you may pay a higher rate of tax on your contributions.

Beneficiaries

Check your beneficiary and update them if needed. A super fund may offer different types of nominations.

Under Superannuation Law, the person(s) you nominate can only be a spouse (including defacto), Child (including adult children, step and adopted children), Financial dependent, or someone in an interdependent relationship with you at the time of your death. Otherwise you can make the nomination to your estate (and ensure your will is up to date).

Insurance

Review your insurance cover. Is your level of cover still appropriate? Do you need to increase your cover to take into account a change in your income or commitments?

The most common types are Death only, Death and Total & Permanent Disablement (TPD), and Income Protection. Some also offer Trauma cover. The type of cover could either be:

Investment Strategy

Does your investment strategy still suit your risk profile? Your investment strategy should match your long term investment goals. If you are considering an investment switch, it may be best to speak to a Financial Planner to explain the implications of your decision.

Fees

What are you paying fees for and how much are you paying? Do the fees include financial advice or is that extra?

What about multiple super funds from previous employers? Or do you have lost super because you changed your name or address. If you have more than one fund, then each super fund will be charging you fees. Most super funds can provide you with a “Combine your super form” which you will need to complete for each fund you want to rollover into to your existing super fund.

Employer Contributions

Have a look at your super contributions. Are they up to date? You can check your payroll slips and make sure that the amount being paid is the same as what is going in. Superannuation Guarantee (SG) Contributions commenced from 1 July 1992. At that time, employers either paid 3% or 4% (depending on total amount of payroll) of your gross salary into your super account. Since then the rate has gone up steadily. It was sitting at 9% for a while, but from 1 July 2013, employers need to pay 9.25%. Under legislation, your employer must pay at least quarterly. If not, follow up with your payroll office.

Generally, you’re entitled to super guarantee contributions from an employer if you’re 18 years old or over and paid $450 or more (before tax) in a month. It doesn’t matter whether you’re full time, part-time or casual or a temporary resident of Australia. If you’re under 18 you must also work more than 30 hours per week to be entitled to super contributions. If you’re a contractor paid wholly or principally for your labour, you’re considered an employee for super purposed and entitiled to super guarantee contributions under the same rules as employees.

From January 2014, your employer will pay into a “MySuper” authorised account if you do not choose a super fund. If you are eligible to choose a fund, your employer must give you a standard choice form.

If your employer forwards member voluntary contributions into your super fund on your behalf, they must be paid into your super fund with 28 days of the end of the month in which they take it from your pay.

Add extra contributions to your super

Adding extra to your super early in your working life means that compounding interest will help your balance grow. Your employer contributions will probably not be enough to ensure your final balance is enough for retirement. There are several ways to add extra to your super:

Concessional (before-tax) contribution

Known as Salary Sacrifice. You sacrifice part of your salary for extra employer contributions which are then taxed at 15% instead of your normal tax rate.

The general concessional (before tax) contributions cap for 2013-14 is $25,000.

However, from 1 July 2013 if you are 59 years old or over on 30 June 2013, additional concessional contributions will be able to be made to your super, with the cap increasing from $25,000 to $35,000.

From 1 July 2014, the higher cap of $35,000 will also apply to people who are 50 years or over.

Non-Concessional (after-tax) contribution

Also known as a personal contribution. You can make a personal contribution to your super (even if you are not working) as long as you are under 65 years of age. If you are age 65 -75 you can only make a personal contribution of you satisfy the work test.

The non-concessional contributions cap for 2013–14 is $150,000. If you are under 65 years old for at least one day of a financial year, you can ‘bring forward’ two years’ worth of contributions, giving you a total non-concessional contributions cap of $450,000 for the three years, rather than a $150,000 cap in each year of the three years.

This may enable you to:

Spouse contribution

A tax offset may apply to a spouse if a spouse makes a contribution to a non-working or low-income-earning spouse super fund, whether married or de facto.

The spouse may be able to claim an 18% tax offset on super contributions of up to $3,000. The maximum tax offset is up to $540 each financial year.

Estate Planning – Essential for everyone

/in Estate Planning /by Fil-BattistiIf you change your view slightly, however, it’s easy to see estate planning in a more positive light. If you have loved ones that depend on you and if you want to ensure that they are properly cared for, estate planning should be important to you.

Estate planning basically ensures that the wealth you have worked hard to build is protected. It reduces the stress on your loved ones or beneficiaries by ensuring that when you pass away or become incapacitated, your wealth is transferred to them smoothly, tax effectively and according to your wishes.

Essential for everyone

The word estate can bring to mind images of vast properties and millions of dollars, but you don’t have to be wealthy to have an estate plan. You also don’t have to wait till you’re older to get your estate affairs in order.

Estate planning is essential for everyone, particularly if you:

Are the parent of minor children Have family members with special needs Have recently bought or sold major assets Have a family trust, self-managed super fund or business, and

Care about your health care treatment.

Why estate planning is important

Estate planning is vital if you want to:

More than just a Will

Estate planning is also more than just having a Will. If you already have a Will, then you’re off to a good start. Most people, however, make the mistake of believing their Will covers all of their assets.

In reality, jointly held assets, trust assets and superannuation are excluded from Wills and should be considered as part of a comprehensive estate plan.

A comprehensive estate plan should include:

Having a valid and up-to-date Will Nominating your beneficiaries for your super Listing beneficiaries for your insurance policies Naming guardians for minor children

Setting up testamentary trusts to reduce tax liabilities for your beneficiaries, and

Choosing a power of attorney to look after your financial and personal affairs if you become incapacitated.

Get your affairs in order

The best time to get your estate affairs in order is now. We can help you set up an estate plan, ensuring you have a valid Will and enough insurance. We can also help you find the most financially and tax effective way to distribute your assets after you pass away.

Source I IOOF

There’s more to income protection than you may think

/in Personal Risk Financial Advice /by Fil-BattistiSome people think that income protection only covers injuries and has limited value for those in low risk occupations. The reality is that it also covers illness, which makes up 40 per cent of claims.

Furthermore, it’s not only illnesses with obvious physical affects that are covered.

Mental illness is responsible for many claims and is by no means uncommon in our community; one in five Australians will experience a mental illness at some stage in their lives.

Many clients are equally unaware of the variety of ways income protection can assist, through supplementary benefits and support beyond the basic income stream. The following real life story dramatically illustrates the value of quality income protection insurance.

How Simon’s story unfolded

In the three months following the death of Simon’s best friend, Simon developed a debilitating post traumatic stress disorder resulting in clinical depression and time off work.

Fortunately, some years earlier Simon had purchased income protection.

This paid him a regular income, which helped replace lost wages. Simon was also offered a rehabilitation benefit, through which he was assigned a rehabilitation adviser.

The rehab adviser developed a management plan and worked with Simon’s GP to identify appropriate courses of therapy.

With Simon unable to return to his own occupation, the rehab adviser engaged a specialist — paid for by insurance — to retrain Simon for the building industry. Simon progressed well and was able to secure his first building job.

A twist in the tale

Long working hours, less family time and medical support took its toll; Simon suffered a relapse. The rehab adviser once again became involved and even organised a personal trainer to help Simon lose weight and to improve his general well-being.

Simon persevered, recovered and was able to recommence work, this time with more on-the-job training and support. Despite the fact that he was working full time, the insurance continued paying partial income support, due to his wages being less than what they were prior to his disability.

Taking the next step

Simon’s story demonstrates the value of quality income protection insurance that goes beyond a simple income stream; insurance that provides holistic support for the complexities that illness can bring.

Source I Asteron

Life is full of unexpected twists and turns. If you found yourself in a situation similar to Simon’s, could you survive without income protection? Don’t leave it to chance; speak to us today about the income protection options available to you.

People seeking support and information about depression can contact Lifeline on 13 11 14 and MensLine Australia 1300 78 99 78.