Understanding Geared Investments

Put simply, gearing is borrowing money to invest with the aim of magnifying, or ‘gearing’, returns. It is important to highlight that gearing investments magnifies losses, as well as gains.

One of the most common forms of geared investments is a mortgage on an investment property. The same principle applies to gearing shares; money is borrowed to invest and the shares are used to secure the loan, just as the property is used to secure a mortgage.

Margin lending and professionally-managed geared funds are two of the most common ways of implementing a gearing strategy in the sharemarket.

How does gearing work?

The key principle behind gearing is quite simple; the investment made with borrowed money is expected to rise by more than it costs to borrow the money.

Let’s say an investor has $10,000 to invest. Over the course of the year their investment rises by 10%. This means their investment is now worth $11,000; a difference of $1,000

To illustrate how borrowing money can magnify returns, let’s say the same investor has $10,000, but this time borrows an additional $30,000, making a total of $40,000 to invest. The investment also rises 10%. This means their investment is now worth $44,000; a difference of $4,000.

While the magnification of returns is plain to see, it’s important to remember that the investment must rise more than the cost of borrowing. In this example, if the interest rate on the loan is 10% pa, the net return is the same as for an ungeared investment.

A geared fund therefore will not always magnify market gains. This is particularly the case in a low-return or high borrowing-cost environment.

As previously mentioned, gearing can magnify losses as well as gains.

This time let’s say the investment falls 10% in value. A $10,000 investment will be worth $9,000; a difference of -$1,000, while a $40,000 investment will be worth $36,000; a difference of -$4,000.

However, again it is again important to remember the cost of borrowing. If the interest rate on the $30,000 loan is 10% pa, that’s an additional $3,000 in costs; a total difference of -$7000.

These examples illustrate that while gearing may not always magnify gains, it will always magnify losses.

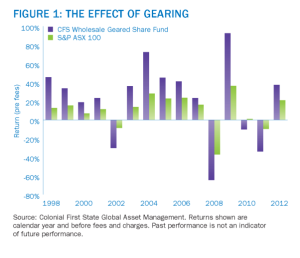

The effect gearing has on returns and the increased volatility is illustrated in Figure 1, which compares the calendar year returns of the Colonial First State Wholesale Geared Share Fund to its benchmark, the S&P ASX 100.

Gearing concepts explained Loan to value ratio

The loan to value ratio (LVR), sometimes known as the gearing ratio, is the amount of gearing undertaken. The higher the LVR, the more risky the strategy becomes.

If an investor has $10,000 to invest and borrows an additional $10,000, the LVR is 50%. This is calculated because the $10,000 borrowed is 50% of the total investment ($20,000).

To securitise a margin loan, lenders will set a maximum LVR, usually around 75%. On a $10,000 loan this would involve borrowing $30,000 to make a $40,000 total investment (a $30,000 loan is 75% of a $40,000 investment).

Margin calls

If an investor takes out a margin loan to invest directly in shares, they are subject to the possibility of a margin call.

A lender can make a margin call if the LVR rises above a certain threshold. Using the example above, if the value of a $40,000 investment drops 10% to $36,000 the LVR becomes 83%.

One of two things must happen when a margin call is made:

• the borrower must make a payment into the loan to bring the LVR back within the threshold or

• the borrower must sell shares; the proceeds of which will go to repay the loan to bring it back within the LVR threshold. This has the undesired effect of crystallising losses in an investment portfolio.

Gearing strategies

Gearing in equity markets can be obtained by taking out a margin (or similar) loan to invest directly in shares, or through a professionally-managed geared fund. There are important differences between the two strategies.

Gearing within a managed fund

The manager of an internally geared fund arranges the borrowing within the fund. This means investors gain access to leveraged market exposure without being personally liable for the fund’s borrowings. There is no personal obligation to repay the debt, as the debt is incurred by the fund as an institutional borrower, rather than by an individual.

Large institutional borrowers can often access cheaper loan rates than are available to individuals. This typically results in a lower borrowing costs compared with other forms of borrowing, such as margin lending. However, there are fees and charges associated with investing in a managed fund which you need to consider Details of fees and charges are available in any fund’s Product Disclosure Statement.

The LVR is usually actively managed by a fund. Therefore investors don’t receive margin calls forcing them to take action, as can occur with margin lending. Most funds will actively monitor gearing levels to ensure they remain within a desired range.

Internally geared funds comply with the superannuation borrowing rules, and are generally permissible investments for superannuation. As many superannuation investors have many years, or even decades, until retirement, investments with long-term horizons, such as internally geared funds, may be a suitable part of an investment portfolio.

Internally managed geared funds are managed by investment professionals who will actively manage the investment decisions and gearing process. This reduces the paperwork and effort which is often involved in other forms of geared investments.

An internally managed geared fund will usually have broad diversification over many companies and sectors. This has the effect of lessening the impact of any individual stock’s or sector’s performance on the overall portfolio. The level of diversification in a managed fund can be difficult to replicate efficiently by individual investors.

Summary

Geared funds are not for everyone, and investors should ensure that they are comfortable with risks associated with geared funds and the potentially large fluctuations, both up and down, in the value of their investment. Investors should also consider an investment outlook of at least seven years. Because of the high risks involved with gearing, it is important to speak with a financial adviser before making an investment decisions.