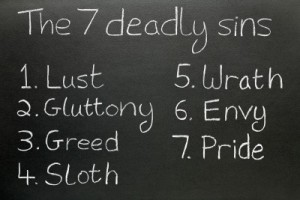

Seven Deadly Financial Sins for Women (and some men!)

Seven Deadly Financial Sins for Women (and some men!)

Seven Deadly Financial Sins for Women (and some men!)

Unless we’re rubbing shoulders with A-listers or running a multi-million dollar fashion business, we need to invest time and effort if we want a successful financial future.

It seems that today’s woman can be easily distracted by the comforts that short term material wealth can provide and these ineffective money management habits are best described as Seven Deadly Financial Sins.

Sin: Sloth

People who stick their head in the sand and are happy to take the lazy approach when it comes to their financial situation may suffer from the financial deadly sin – Sloth.

Rescue yourself by…

Taking charge of your financial affairs, starting with your superannuation and find lost super by logging onto the ATO’s Super Seeker website at http://www.ato.gov.au/super.

Sin: Anger

Finding excuses or others to blame for your financial situation doesn’t make it go away.

Rescue yourself by …

Take a reality check by doing a budget based on your income and expenses. You may be surprised. Visit the budget planner tool on the ATO website. If it helps curb your needless spending ways, then you shouldn’t be angry any longer.

Sin: Greed

People of today live in a ‘now’ society and the risk of this behaviour is that it may trap you into spending more than you earn.

Rescue yourself by…

Building your wealth through sound financial strategies that suit your financial and lifestyle needs. This can give you peace of mind to have all that you want – with a little discipline.

Sin: Damsel in distress

Ladies (or fellas) in-waiting on the lookout for a knight in shining armour to rescue them from the burdens of their financial situation is otherwise known as Cinderella syndrome.

Rescue yourself by…

Saving regularly – just $20 per week can add up to over $7000 in five years in an online high interest bearing account.

Sin: Gluttony

Ladies with an appetite for debt and credit cards to feed their addiction may suffer from the financial deadly sin of Gluttony. Online shopping and VIP nights at your favourite department stores feed on gluttonous appetites and before you know it, you’re in way over your head.

Rescue yourself by …

Spring cleaning your debt – start with cutting up store cards and start to seriously consider protecting your wealth.

Income protection insurance will provide you an income when you’re sick or injured and unable to return to work.

Sin: Lust

It can be hard to resist a good deal and retailers enhance their businesses to appear irresistible with ambient music and designer scents – all to put shoppers in the mood for spending money.

Rescue yourself by…

Take control of your financial future and put a portion of your regular income into savings and investments so it’s not all lost through the temptation of impulse shopping.

Sin: Envy

Don’t hold a vendetta, do something about your financial situation if you’re not happy with it.

Rescue yourself by …

Consider an investment plan that works for your short, medium and long term goals.

Be your own fairy Godmother

It’s never too late to rescue yourself and take control of your financial destiny. Your financial planner (hint! hint! ) can provide straightforward and transparent financial advice by helping you with your current situation and implementing a plan to meet your needs in every stage of your life.

It’s never too late to rescue yourself and take control of your financial destiny. Your financial planner (hint! hint! ) can provide straightforward and transparent financial advice by helping you with your current situation and implementing a plan to meet your needs in every stage of your life.

Source | MLC