Investing for the long term

Getting your mental game right

One of the most influential figures of modern investment theory is Benjamin Graham. Among his numerous protégés is the most famous investor of all time, Warren Buffett. Benjamin Graham began his course at the Columbia Business School by saying “If you want to make money in Wall Street you must have the proper psychological attitude.” Or, as the equally famous baseball identity, Yogi Berra would say “90% of investment is half mental.”

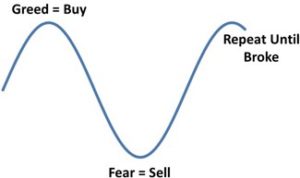

The basic insight here is that most investment success (or failure!) is driven by emotion, rather than faulty logic. Investors are seduced by the ‘greed and fear’ cycle to buy (or sell!) investments at precisely the wrong moment. Just as markets peak, they experience all the euphoria and leverage themselves to the maximum to buy investments at their most expensive. Then as markets decline, they become increasingly fearful, capitulating at the bottom of the cycle. Observers of the recent ‘Brexit’ vote in the UK would do well to recall this truth. It is important to separate well-founded negative sentiment, based on a rational analysis of developments in relevant markets, from mere fear triggered by the uncertainty of dynamic world events.

By looking long term, you can see past the emotions of the moment and recognise the cycles as they occur. Instead of being a risk to your investment outcomes, the greed and fear cycle can begin to work in your favour. You then have the ability to follow the advice of Warren Buffett to “…be fearful when others are greedy and greedy when others are fearful…”

The power of compounding

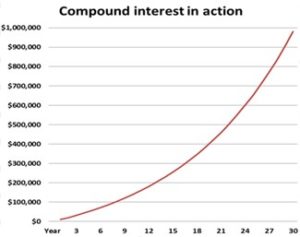

The second advantage of taking a long term and patient approach to investment is that it allows you to unleash some seriously potent forces. Legend has it that Albert Einstein was once asked to nominate the most powerful force in the universe. He chose compound interest.

To see how this could be the case, consider the following scenario. Imagine you put aside $10,000 at the end of each year for your retirement. Imagine further that your investment is earning 7.21% p.a. (the average annual return of La Trobe Financial’s Pooled Mortgages Option since inception in October 2002).

After year one, you would have your initial $10,000 investment. After year two, you would have $20,721, being your contributions of $20,000, plus interest of $721. After ten years, you would have $139,543, being your $100,000 of contributions, plus $39,543 of accumulated interest.

Here is where things get really interesting. As your principal sum grows, you earn interest on the larger amount. That means that the amount of interest you earn grows each year. In year two (after making your initial investment) you earn $721 in interest. After year ten, you are earning $10,061 in interest on top of your regular contribution of $10,000. But after year twenty you are earning $30,244 in interest and after year thirty you are earning a massive $70,734.45. What’s more, your principal amount at the end of year 30 is $981,060, despite your total contributions coming to just $300,000.

As you can see, the longer you’re in the game, the more compound interest works for you. That’s why getting rich slowly never goes out of fashion.

Long term investment

In the context of long term investment, it is worth noting that the ASX and Russell Investments have recently released the 2016 Long Term Investing Report. This report looks at some of the key asset classes and their performance over longer term horizons (generally 10 and 20 years).

In this year’s report, the long term performance of the various asset classes were compared to a benchmark seen to be appropriate for a ‘reasonable’ balanced investor investing in a portfolio comprised of 70% growth and 30% defensive assets. This benchmark was set at a level of CPI plus 4% p.a. or an average of 6.6% p.a. over the 10 year period to end of December 2015.

What about SMSFs?

A new report challenges whether some SMSFs are delivering appropriate outcomes for investors. According to an article in the SMH, “Between 2010 and 2014, the bottom 10 per cent of SMSFs, those with balances of less than $100,000, have lost money every year since 2008, according to Australian Taxation Office figures. The ATO figures reveal that 44 per cent of SMSFs have on average not made a return over the past seven years.”

So what can these investors do? It’s actually not that difficult. They need to review their investment strategy. This is where the three golden rules of investment could be useful. Pick those investments that you understand, diversify your holdings and take a patient, long-term approach.

Source: La Trobe Financial