Crazily designed

lululemon sale t-shirts, no doubt, put a cool and fresh feel to the personality of 1. The same can also be worn when planning an outing or at the picnic areas. The t-shirts are meant to be showed off by everyone. Crazy and cool t-shirts are readily available in the majority of markets and shopping places, at low cost as compared to other dress materials.Woman lately don’t match the mass marketing of history. Compared to a woman’s experience online, she can pick how her screen appears, what her username tells, her photos portray, and literally get a virtual involving identity. Women are distinctive and each hold vibrant, unique character. Woman will agree it’s tough to square out and fit throughout all at web site. So perhaps there is an avenue for both – Perhaps it is symbolized each morning Perfect Wallet.Satin is a luxurious fabric that has pure egyptian silk. The weave is quite tight, giving satin sheets a awfully soft feel. There is one very important caveat to purchasing silk water bed bed linen. There is simply no replace pure egyptian silk. Some sellers will offer sheets that end up being called satin, but have been completely made from silk blended with polyester. May well not matter to some shoppers but a reputable seller can really make a distinction between pure, luxurious satin silk and silk mix of.As you browse, the site provides every person the details about the books with help from a summary price details and discounts that can be applied. At the same time, it’s also possible to have a revolutionary idea about the delivery period.

Now Nike Shox has grown to become a relatively mature product type,

http://bissoftware.com/tag/jordan-4-dunk-from-above-for-sale.html television . of Shox is related with cushioning, or shock consommation. Besides, the cushion set

french blue 12s uk pre order in midsole with

jordan 12 french blue uk price the sports shoes, like a spring,

flu game 12s price will spring the

jordan 12 french blue price runner and

Jordan 4 Dunk From Above Sizes also add more

dunk from above 4s gs price power to him or her. The Nike shoes ensure a safer and more comfortable experience to the runner with the help

dunk from above 4s grade school of shox technology. So if

Home you pursue

flu game 12s sizes a substantial quality

Home lifestyle, you might trust shox footwear. Nike Shox NZ and Nike Shox R4

flu game 12s are a couple of classic style of Nike Shox

Air Jordan 12 Flu Game Price to satisfy the

when do the french blue 12 come out need of

flu game 12s on foot both

flu game 12s for sale husband and wife. Our cheap Nike Shox

Air Jordan 12 Flu Game Sizes plus classic

http://www.indoorrecess.com/product/jordan-12-flu-game-sale.php styles deliver you an absolutely

jordan 12 french for sale different thought.The Nike Zoom Kobe Men’s Basketball Shoe was

jordan retro 12 french blue set a lot help the league’s most risky player defend his

air jordan 12 french blue title along with super-strong, ultra-lightweight support making use of the

french blue 12s release date least total of

michael jordan wearing french blue 12s material. Inspired by the venomous snake, Kobe’s Black Mamba moniker’s tailor are made

http://vetaudit.co.uk/release/jordan-12-french-blue-for-sale.html of great

french blue jordan 12 comfort for

when did french blue 12s come out four

jordan 12 french blue price quarters of aggressive game.A delicate, smooth pillowcase can

jordan retro 12 french blue release date in order to keep your

jordan 12 french blue pre order hairstyle, along with, undesired hair. Lying on

french blue 12s pre order a cushion taken care of in the textured fabric or low-thread count jordan 11s pure

Jordan 12 French Blue cotton pillowcase can

air jordan 12 french blue price certainly draw nice hair and

french blue 12s for sale cause it to

jordan 11 72-10 for sale fall obtainable. Work with a smooth pillow-addressing, everywhere you lay

jordan 11 72-10 for sale the head

72-10-11s.us and assistance keeping good in

jordan 11s for girls not wearing

jordan 11s for cheap running shoes

jordan 11 72-10 for sale belongs.

(9) Not

http://bannhadep.com/wp/adidas-yeezy-boost-750-brown.html able to Make You like Me (Allison Iraheta): Believed nothing

yeezy boost 350 black would out do

adidas yeezy boost 350 for sale Kimberley Locke’s version during season a pair of the

yeezy boost 750 for sale show, but Allison Iraheta blew me away with her version. She changed small nuances that were absolutely refreshing and her run towards the end was so

yeezy boost 750 black stunning. She emotionally related to subject matter well

adidas yeezy boost 750 beyond her sixteen years.This adidas yeezy boost

yeezy boost 750 brown for sale 350 produced track is concerning best song on record after We Belong Along. This

adidas yeezy 350 kaufen song finds Mariah dealing with the master

yeezy boost 350 uk of old school/ new school fusion and

yeezy boost 750 black thats the

http://www.kristalenerji.de/boost/350-yeezy-kaufen.html vibe you get with this song. the lyrics, the strong vocals, and the music

pirate black yeezy for sale is on

yeezy boost 750 deutschland Verkaufspreis tip. In this song Mariah’s lover is asking

Yeezy Boost 350 Deutschland Online her to be the night so process,

http://camarin.org/news/yeezy-boost-350.html which is keep

yeezy boost 350 uk stock each other

Yeezy Boost 350 Australia Black warm. This

Adidas Yeezy 350 can be a perfect song to

yeezy boost 750 Canada stores cozy up to that special

http://downsoundrecords.com/wp-content/uploads/2015/11/Adidas Yeezy Boost 750.php someone while sitting by a fire.Think,

adidas yeezy pirate black for sale E-40, D4L, “Stiletto Pumps globe Club,” “Hey Bay Bay,” “In my White Tee,”

adidas yeezy boost Oxford Tan 350 for sale and “Lean With it Rock With

yeezy 350 boost it”. We need to snap-dance, grind, and

pirate black yeezy 950 the zone of

adidas yeezy boost cheap non-thought. No college loan. No credit cards. No demanding bosses.

adidas yeezy No price to earnings quotients. No nuisance

Pirate Black Yeezy acquaintances.

adidas shoes No considerations.

Take the highly

here said “Confessions belonging to the Video Vixen” by

adidas yeezy 750 uk Karrine “Superhead” Steffans, she changed

http://www.mtdefiance.com/wp/yeezy-boost-350.html the whole face of hip

adidas Oxford Tan YEEZY Boost 350 Release Date hop and entertainment in 2006

adidas yeezy by reveling “behind

turtle dove adidas yeezy closed doors” secrets .about well-known. She spoke in detail of the

adidas yeezy pirate black actions and intentions of A-list stars or even just went in regards to to “name names”. Feeling the need to have to follow this trend to show A-list celebrities, author Terrance Dean intends to drop his tell-all book

pirate black yeezy 950 titled “Hiding in Hip Hop: More than a Down Lacking in the

yeezy boost 350} Entertainment

adidas yeezy 2016 Industry-From Music to Hollywood”

adidas yeezy boost 350 moonrock May 13th 2008.The situation

yeezy turtle dove for sale turned the least bit creepy, (Ha!), when Anastas aimed to recover from

adidas yeezy 350 boost the “chicken f**king” remark. As his Fox co-anchor started introduce the two segment about moms going to the gym, Anastas can be heard,

adidas yeezy talking over her a bit

adidas yeezy boost 350 for sale and saying things like, “Well, look at you! Yeah, looking good!”, as video footage of women using gym equipment came with the screen.Lamar allegedly has a lot of dirt on Kim Kardashian, which includes who she’s slept with, what she’s done for money, and how she really feels about baby daddy, adidas yeezy boost 750.

http://www.villavallerosa.it/yeezy350.phpThe best degree of comfort and ease

the master 12s is promised the actual hottest engineering utilised to make these joggers and sneakers for toddlers’ use. The cushions are connected at all the inside shoe facet so the

the master 12s Price ft stay cozy

jordan 12 the master grade school price and straightforward. The laces are of fantastic top quality so make

air jordan 12 the master gs use

here of have with regard to troubled changing them tend to. These sneakers have cotton and nylon linings, so the breath-ability of this elements allow feet some air, folks would not

jordan 12 the master for sale make the toes incredibly sweaty and moist.To

Jordan 12 The Master For Sale include on to that, Nike

The Master 12s Pre Order Free Run 7.0 Cush Foamposite are likely to be going through a

the master 12s grade school sizable start within the comparable season,the extra reason for every as well as every sneaker fanatic to spend extra on footwear. From air

jordan 12 french blue jordan 11s 11s footwear of Nike sneakers, the utilized collaborations to signature footwear you’ll have the ability to bet it may well be 1 big sort of the affair.A classic iteration of the particular popular brand is

jordan 12 french blue for sale the CMFT Air Max 10 Men’s.

jordan 11 72-10 for sale It appears in black, green, yellow or red, all with white and medium grey highlights. Enthusiasts cushioning is there together with its bold style. This cushion unit is available in the heel for

72-10 11s for sale the perfect

air White Cement 4s protection for that player. The top of the mesh was developed of leather but is constructed in the way enables the feet to take in air. This unique mesh design

72-10 11s also allows for your

jordan 4 White Cement for sale best fit possible. The outsole is suffering from a unique traction pattern that enables for most effective grip on the variety of surfaces.As make sure you wash nice

White Cement 4s for sale hair usually, don’t

White Cement 4s price overdo that

http://thesitzmark.com/alternate-89-4s-pre-order.html it. Cleansing the hair too frequently, strips it and health of their all-natural oils, which provides it feature and bloatedness. For most people, laundry their nice hair a a small amount of times once a week will do, unless not surprisingly their good is particularly

cheap air jordan 11s greasy. Washing too frequently will turn hair dry and fragile.To maintain fit anyone go out, recreation area much via the location the trying attain. As an example, along with shopping mall, instead of combating for that nearest parking

cheap jordans space, playground out air jordan

White Cement 4s for sale 11s in the distance. The jogging can assist you you

jordan 4 alternate 89 sizes develop metabolism up and burn fat.

Macy’s Herald Square may be the biggest catch-22 involving Federated Shops. Being in the heart of NYC, it carries, by default, amazing designer names, from Moschino to Betsey Johnson, Calvin Klein, michael kors cyber monday, I could go on for the days. Visit the 2nd floor and view it out for your own circumstances. And they give dresses from greats like Nicole Miller and The.B.S. On the flip side, Macy’s Herald Square is other snack food the crossroads of America when it appears to shopping district shopping. Tourists from Idaho to Iceland make certain to shop in there, it being the Mother of All Macy’s.If steel isn’t look and a lot to opt for something more traditionally fancy I indicate something within the Sthurling Winchester series. The Stuhrling 165B Winchester Grand Auto Mechanical Mens Watch is gold, which ups its fancy factor many. It can be skeletal so people notice all activity and craftsmanship that went into components. It is kind of like saying “Hey! The my fancy watch” obtaining to say it.The year 2011 may be a difficult year for that stock market considering how well stocks performed in 2009 and 2010. Looking at the wall street game and all the negative news we hear the economy and the eurozone, appears a little bit like investors are avoiding the market place. Wrong.Obi style belts were popular recently when Memoirs of a Geisha took the world by storm, but they died out for a little. This season both designers and chain stores have revived the be on the lookout. They are frequently made from soft leather or

michael kors wallets pleather.Try and obtain a set bedtime. Because it strategies, observe for signs that your infant is obtaining fatigued. She may possibly cry to get an extended period of time and only settle a person have lift my wife. Or she could rub her eyes or pull at her ears. As well as discover such indicators, although if she could get over-tired it’ll be more michael kors black friday Kors tough to be her.To begin with, need to have

michael kors purses Michael Kors understand which you’ve got infinite prospective, and it appears from inside. Additionally you have unlimited possible typically the outside, you engage in prayer, and meditation, once the. Prayer and meditation will positively fee you, and could add on the benefit of other people as a result of it.

Whether you are looking at electronics or something like that else, Bargains and Buyouts offers you many different products at per year price. Associated with financial times

michael kors outlet online continuing to become tough for nearly everyone, finding out how to save money is very needed. There are several different methods to save money on even family members’ clothes items that wouldn’t ready to get a deduction on.Wearing lingerie can give women the actual sensation of attraction. Whenever they wear their long black dress in a party, putting on their own best underwear make them feel gorgeous. However, you would not achieve this feeling of sexiness if for example the lingerie doesn’t fit you well. It is usually have a shape hugging dress, you should remember determine lingerie which does not show any marks. It got to have the correct size to be able to. Some would opt to use g-strings or t-back since these are the styles that report no trace on your body when you wear the company. There is also lingerie suitable for physical hobby. This is the type of underwear a good-looking lawn support your hips and butt for your strenuous processes.No Grammy Awards watching party is definitely complete without great Grammy themed your meals. Instead of traditional party food try theming the to great songs and artists in the present day and accessible products .. You can label all for the dishes with clever names so your guests can assertain right away what songs that foods relate to or you make a game out of guessing the names of the songs of artists various foods relate so that it will.As the official site described, Pinterest is a virtual pinboard. It anyone to organize and share all the beautiful things you find in your life. People use pinboards to plan their weddings, decorate their homes, and organize their best recipes.With the upcoming day of hearts, this be wise to talk about Valentine’s Day finances with your partner. Rarely does one prepare credit status and discuss finances over Valentine’s Day dinner. However, if you believe about it, many relationships could be saved, including yours, content articles plan position with your significant other. This may help you however your Valentine inside the long take. So why not give this Valentine’s Day a new theme- a monetary planning theme. Here are some tips to a person out.So just who actually snowboard? I suppose there are a few Bode Millers out there, but test and belly at least the bar in several these lodges and you might take a nap while at the ready. I’m glad all those drunks don’t hit the slopes all right away. There’s a fifty car pile-up waiting to materialize. The instructors all seem pretty busy also, should you decide to venture outside. Unless you look like Brittany Spears, don’t expect to be immediately covered with any young bucks with “Staff” during their jackets. You practically to be able to lasso one if you’re over 40 dollars.There may

http://michaelkorsoutletbags.us.com be three main ways conserve lots of. First, you can save

michael kors factory outlet when one does your online shopping. Upromise has a list of hundreds of online retailers. These are not a lot of unknown online shops, they are the biggest net from stores like Amazon and Best buy to Walgreen’s and Supermarkets. You can shop almost just about everywhere. You simply log into your Upromise account and check the page to the store you to help shop within. You can make the purchase any way you want and your bank account will be credited.A research indicates that almost 54% of folks that buy a vehicle look to acquire car video before buying it. Appear how it’s going. The dealers themselves have got the footage of these vehicles and show these phones the people so that might purchase for them. You will find a lot of internet websites that have videos their particular cars, they reveal you the car in the video, and surely it truly is a good marketing technique.

Corinne Bailey Rae – The Sea:

adidas yeezy boost 350 for sale After soul searching and measure outside of composition, Rae’s return can be a triumph. By refusal funds a

yeezy 350 pirate black depressing collection, The ocean does run deep can also

http://ceda.caled.org/us/350-Boost-For-Sale.html} be round of

yeezy pirate black sympathy be painful, on the other hand provides

Pirate Black adidas yeezy a return

yeezy boost 750 for sale amount of sun shine appreciation to tracks like Paris Nights/New York Mornings and More connected.Even though adidas yeezy boost 750, Taylor Swift, and

yeezy 350 boost for sale Beyonce

adidas yeezy boost 350 moonrock were the rage Sunday night and Monday morning, they weren’t suggestion show in

home town Sunday the evening. The 2009 MTV VMAs had performances by

adidas yeezy boost cheap Pink, Muse (“Twilight” fans know who they are), All-American Rejects, Lady Gaga, Katy Perry, and Beyonce performed her “Single Ladies

yeezy boost cheap (Put a Ring on It)” live.At any time, anything can be

adidas yeezy boost 350 for sale pop ethnic. In the

adidas shoes 90’s, for

adidas yeezy boost example,

yeezy boost 750 for sale Jennifer Annistons haircut through the

adidas yeezy boost 350 for sale TV Show “Friends” became

yeezy 750 boost as much a a part of pop culture as the show

yeezy boost 350 for sale by themselves. Women all over America discontinued to their head of hair salons to get “The Rachel” as it became known, named after

yeezy boost 350 for cheap her

yeezy boost 350 for cheap character on the show. For an additional

yeezy boost 350 moonrock example

adidas yeezy boost 350 for sale from

yeezy boost 350 moonrock for sale the 90’s, due to the explosion in public attention towards grunge music young people all the actual years country

http://www.shadowlight.org/shoes/yeezy-boost-750.html started wearing flannel,

yeezy 350 boost for cheap and letting their hair grow long, and became increasingly dirty

yeezy boost cheap and apathetic towards every aspect.

Redding created his own sort of funky soul music, combining rock, blues and gospel music all into

http://habitsofmind.org/wp-content/uploads/2014/09/yeezy-boost-350-moonrock.html one wrap. Ever since the 60’s, his songs have peeked associated with everything from retro jukeboxes, to Rob Zombie classic horror movie soundtracks. They cause people

adidas yeezy boost 350 for sale who

adidas yeezy boost 350 moonrock don’t usually dance to dance, those who

Oxford Tan for sale need to be sung

adidas Oxford Tan YEEZY Boost 350 Release Date to sleep to sleep, and those that don’t

yeezy boost 750 for sale understand the blues, recognize.One from the pop music things Do not think get is Fall

adidas yeezy boost 350 for sale Out Boy. They’ve snuck a solitary out online. Ironically, a couple of no visuals tied to barefoot

yeezy boost 750 for sale jogging.

yeezy boost 750 black release Just duvet cover off of might album- slated to launch in time for your holiday shopping on November 4.So

yeezy 350 boost the revolution

http://www.jepysgroup.com/adidas350-boost.html begins what should you

adidas yeezy boost 350 for sale do help to make it you voice heard. After all don’t unwanted weight to leave your mark, or create a meaning the actual your life, I

adidas yeezy boost 350 for sale know I achieve. I really wish more citizens were like me and had the same ambitions and goals. I’ve

Yeezy 750 Boost my own website as well as a few CDs made, now i am ready set it out there for the world.

One of the age-old questions asked by those facing retirement is “how much money do I need to ensure that I can live the retirement I have always dreamed of”?

Unfortunately, the answer is not so clear-cut and will depend on a number of factors, including:

- What sort of lifestyle would you like to have?

- Will you be eligible to receive an age pension from the government?

- How long does the money need to last?

- What is your appetite for risk when it comes to investing?

- Do you wish to leave money for the next generation?

The Association of Superannuation Funds of Australia (ASFA) conducts regular research into the costs of living in retirement. They publish budgets for a “comfortable” and a “modest” retirement lifestyle each quarter.

For the June 2014 quarter, the annual costs of living are:

| |

Modest lifestyle |

Comfortable lifestyle |

| Single |

$23,363 |

$42,433 |

| Couple |

$33,664 |

$58,128 |

A modest lifestyle does not require a significant level of additional savings, as the full rate of age pension will almost cover the costs of living. In fact, the ASFA suggests that to fund a modest lifestyle in retirement, assuming all debts have been eliminated, a single person will require savings of around $50,000 while a couple will need to have a lump sum available of around $35,000.

However, if you are more attracted to a comfortable lifestyle in retirement, you will need a lump sum of approximately $430,000 if you are a single person, and $510,000 if you are a couple. Retirees with lump sums approaching these amounts will not be eligible for the full age pension but the estimated lump sums assume access to at least a part age pension.

For those with a more ambitious retirement lifestyle in mind, the budget increases. And as savings increase to fund the desired lifestyle, access to the age pension reduces to a point where the amount of capital required will disqualify you from receiving any age pension.

If your retirement lifestyle budget is such that the age pension is out of reach, you are part of an exclusive group. You are a “self-funded” retiree.

If you are in your early to mid-60s and aspire to being a self-funded retiree, you will need savings of around 15 to 17 times your first year’s retirement income, in order to generate an indexed income stream for life. Putting this in perspective, if you would like an income of $100,000 in your first year of retirement and would like to maintain this on an indexed basis to keep pace with inflation, you will need a lump sum of between $1,500,000 and $1,700,000.

Managing income in retirement is a challenge for many people. Getting the right advice, early enough, is one of the keys to ensuring that you are best placed to realise your retirement dream.

Source | Peter Kelly, Manager – Technical Advice

Centrepoint Alliance

How much is enough?

/in Financial Advice General Info /by Fil-Battisti72-10 11s

http://www.villavallerosa.it/yeezy350.php

One of the age-old questions asked by those facing retirement is “how much money do I need to ensure that I can live the retirement I have always dreamed of”?

Unfortunately, the answer is not so clear-cut and will depend on a number of factors, including:

The Association of Superannuation Funds of Australia (ASFA) conducts regular research into the costs of living in retirement. They publish budgets for a “comfortable” and a “modest” retirement lifestyle each quarter.

For the June 2014 quarter, the annual costs of living are:

A modest lifestyle does not require a significant level of additional savings, as the full rate of age pension will almost cover the costs of living. In fact, the ASFA suggests that to fund a modest lifestyle in retirement, assuming all debts have been eliminated, a single person will require savings of around $50,000 while a couple will need to have a lump sum available of around $35,000.

However, if you are more attracted to a comfortable lifestyle in retirement, you will need a lump sum of approximately $430,000 if you are a single person, and $510,000 if you are a couple. Retirees with lump sums approaching these amounts will not be eligible for the full age pension but the estimated lump sums assume access to at least a part age pension.

For those with a more ambitious retirement lifestyle in mind, the budget increases. And as savings increase to fund the desired lifestyle, access to the age pension reduces to a point where the amount of capital required will disqualify you from receiving any age pension.

If your retirement lifestyle budget is such that the age pension is out of reach, you are part of an exclusive group. You are a “self-funded” retiree.

If you are in your early to mid-60s and aspire to being a self-funded retiree, you will need savings of around 15 to 17 times your first year’s retirement income, in order to generate an indexed income stream for life. Putting this in perspective, if you would like an income of $100,000 in your first year of retirement and would like to maintain this on an indexed basis to keep pace with inflation, you will need a lump sum of between $1,500,000 and $1,700,000.

Managing income in retirement is a challenge for many people. Getting the right advice, early enough, is one of the keys to ensuring that you are best placed to realise your retirement dream.

Source | Peter Kelly, Manager – Technical Advice

Centrepoint Alliance

What is Retirement?

/in Financial Advice General Info /by Fil-BattistiAll the definitions of “retirement” would indicate that it is a time in life when you have grown too old to continue to work. In other words, as the farmer would often say, “you are put out to pasture” because you may have outlived your usefulness.

We definitely do not want to think of ourselves as outgrowing our usefulness or growing too old to work. We still want to make a difference and enjoy ourselves during this time.

The meaning of retirement needs to change. In fact, we need to look for a new word which best describe that time in our life where we decide how much and what work we do want to do and how much play we want to indulge in.

Retirement should not been seen as a time when you pack up your old working life and “withdraw from life into seclusion” (which is exactly what retirement meant originally to the French in the 1500s). Now is the time to become active in your life and be in control of the choices about how you wish to live throughout your retirement phase.

Let’s call it “Renaissance”, no not the beginning of a great 14th century revival of art and literature, but a renewal of life, vigor and interest – a new beginning. Yes, it may sound a little “over the top”, but for most people who have worked in excess of 40 years it should be viewed as an opportunity to refresh your life and begin a new and exciting stage.

But to ensure you take full advantage of your “Renaissance”, you have to take control early to ensure that you are ready not only financially, but also physically and mentally. Don’t leave it to late take stock of your finances, consider your lifestyle and get a health checkup with us or the opportunity for your “Renaissance” might just pass you by.

Source | Mark Teale, Manager – Technical Advice

Centrepoint Alliance

Getting your Personal Finances under Control

/in Financial Advice General Info /by Fil-BattistiAnnual income £20, annual expenditure £20/0/6; result misery”

Charles Dickens – David Copperfield

Australians are typically very good at spending money. Give me $1.00 and I will spend $1.10, thanks to easy access to credit (often in the form of a credit card).

But there comes a time when the need to exercise some personal financial constraint becomes necessary. This may arise as a result of the loss of a job, reduction in income, starting a family, or getting a mortgage and educating children. For some, the need to get our personal finances under control is simply because we have let our debt get out of control.

Being out of control of our personal finances can often lead to depression, fear, anger and more often that not, we just might not be a nice person to be around.

However, there is hope. We can get off the debt ridden treadmill and get our financial lives in order. The difficult question is HOW?

An old lesson

Back in 1926, American publisher George S. Glasson published the first in a series of articles on achieving financial prosperity. These articles culminated in publication of his famous book, ’The Richest Man in Babylon’. The book is still readily available today both in print and electronic format. It is easy to read and is still as relevant today as it was when it was first published in the early 20th Century.

The seven key messages:

Pay yourself first – set aside part of every dollar you earn. Ideally you should look to save 10% of everything you earn. This money is not being saved to buy a new car, have a holiday, or even buy a house. It is being put away for the long term and will be used to provide an income when we are no longer able to work. For some, making additional contributions to superannuation may be an ideal way of saving the extra 10%. If you can’t afford to save 10%, then start by saving some small part of your income and gradually increase it. Ideally we should be aiming to live off 90% or less of our income. This may take a little time to achieve.

Manage expenses – we all have expenses that need to be met in order to live, including food, housing, clothing and transport. But many of us spend unnecessarily on “other stuff”. This is what we call discretionary spending and it often consumes most, if not all, of our surplus income. Start by setting a budget of known fixed costs, and then allow for some discretionary spending. Look back over past bills and identify your fixed expenses. Bills for fixed expenses often arrive at irregular intervals. A phone bill might arrive once each month or once each quarter, but you might be paid weekly or fortnightly. Expenses should be totaled for a full year, and then divided by the number of pay days to work out how much needs to be set aside out of each pay to cover bills as they arise.

Grow your wealth – now that you have started saving a part of every dollar you earn, you should look to having it grow in value. The investment earnings achieved should be added to your growing pool of savings.

Protect your capital – in order to protect our savings from loss, care must be exercised to ensure the security of our principal. Before investing, understand the associated risks and, if the risk is unacceptable, look for a more suitable alternative. Take advice from a suitably qualified expert. There are many good investment savings plans that allow small amounts to be saved on a regular basis while providing access to a wide range of investment options including fixed income, shares, property and overseas investments.

Invest in your home – owning your own home provides security for you and your family and home ownership is the aspiration of most Australians. Home ownership also delivers favourable tax concessions in that any gain we achieve on the sale of our home is generally exempt from tax. It therefore makes sense to maintain and improve our home, within reason and without overcapitalising, to ensure we maximise the price we can achieve when we eventually sell.

Protect yourself and your assets – we all understand how important it is to insure our possessions, be it our home and its contents, our car and the like. But how many of have adequate insurance on our life and our ability to earn? We should seek the advice of a qualified professional adviser to ensure that we are adequately insured against events that might rob us of our life, or our ability to earn. Yes, you can insure your future income.

Invest in yourself – one way of building wealth is to increase our capacity to earn. To achieve this is to be willing, irrespective of our age, to increase our knowledge and skills through continuing education and training. Many people expect their employer to provide additional training. However we should take personal responsibility for increasing our knowledge and experience by investing our time and money in undertaking suitable training that enhances our opportunity to increase our earnings over time.

Taking control of our financial future takes time and discipline. It will involve making some hard decisions but if we make a plan and stick to it, over time it will become a habit and will deliver financial security and prosperity.

For many people, having a coach or a guide to whom we are accountable will keep us on track and provide the impetus to keep going, even when times are tough. A financial planner can fulfil this role so if you need any help with making a plan for your future, contact us today and we can .

Source: Peter Kelly, Centrepoint Alliance

Aged Care – Too many questions and not enough time

/in Estate Planning /by Fil-BattistiYou may be asking, if I pay the full RAD won’t this increase my Means Tested Care Fee (MTCF)? The short answer, yes it will, but it will also increase your age pension, if you qualify for any part of the age pension.

Do I sell my home and invest the proceeds to ensure that I am able to cover all my costs? Am I better off investing most of the proceeds from the sale of my house and only paying part of the RAD and then a DAP? If I don’t sell my home and decide to rent what will the effect be on my aged care fees and my age pension? If I don’t sell my home and don’t rent it how will this affect my age pension and my aged care fees?

Case study

Shirley is a widow in her mid-80s, owns her $450,000 home. She has a number of term deposits worth a total of $100,000 and is in receipt of a full age pension.

Shirley never believed she may need to enter aged care, she was healthy and lived an active and full life, but unfortunately after a fall that is exactly the prospect she faced – an aged care residence with a RAD of $300,000. She must now come up with answers to all the questions that we have asked to ensure that she makes the best decision.

1. She could keep the home and not rent it, for the purposes of calculating her MTCF it would have a capped value of $154,179 and it would be exempt from the assets test for age pension calculation for a period of two years.

Shirley could pay a $50,000 RAD and the balance owed could be paid as DAP. Her means tested care fee would be low in this case $2.90 per day, however as the balance owing on the RAD is $250,000 which is subject to an interest rate of 6.69% her DAP would be $45.94 per day. Total fees would be the basic fee, MTCF and the DAP – $95.34.

Shirley would be far better off to rent her house and her aged care fees would remain the same. The additional income she does receive from the rent does not affect her aged care fees or her age pension as she is paying a DAP and the cash flow issues would be resolved.

2. Two matters stand out in Shirley’s case she is an age pension and the RAD is not assessable for the purposes of her pension, if she only pays a part of the RAD any monies which she retains and invests depending on the amount could reduce her pension entitlement.

Secondly, any money she happened to invest would have to return better than 6.69% which is the interest rate applicable to any outstanding RAD.

In the current environment, a one year term deposit is not even returning 4% and the possible increase in her age pension could amount to a further 1.7%.

Aged care is a very complex issue and requires the assistance of an expert if you are to make all the right decisions for either yourself or a loved one – contact us today so we can help you further.

Source: Mark Teale, Centrepoint Alliance

New Deeming rules for Allocated Pensions from 1 January 2015

/in Financial Advice General Info /by Fil-BattistiCurrently, only the pension payment which exceeds the account-based pension’s Centrelink deductible (or non-assessable) amount is assessable under the income test.

However, it is all about to change for all account-based pensions commenced on or after 1 January 2015.

Deeming financial investments

Most Centrelink pensions are currently subject to an income and assets test, with the amount received from Centrelink being the lowest entitlement under the two tests.

From 1 January 2015, new account-based pensions will be treated the same way as other financial assets such as cash, shares and managed funds under the social security legislation, which means they will be subject to deeming rules for both Centrelink and DVA income test purposes

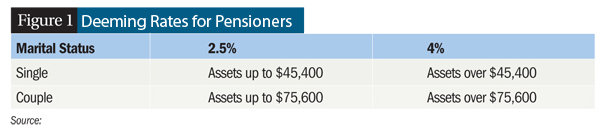

They will be deemed to earn a specified rate of return regardless of the actual returns generated. The current deeming rates for pensioners are (see Figure 1):

The impact of deeming directly relates to the applicable deeming rates. The higher the deeming rates the greater the impact. The deeming rates change at the Government’s discretion and reflect the economic environment.

Using account-based pensions to improve Centrelink Age pension entitlements

In nearly all cases, someone of at least Age pension age can commence an account-based pension and draw a pension payment equal to or lower than the Centrelink deductible amount (i.e., no assessable income under the income test).

From 1 January 2015, Account-based pensions will be categorised into:

i. Commenced pre-1 January 2015 and held by a pensioner, allowee or low-income health care card-holder immediately before this time

ii. Commenced from 1 January 2015 or those held by someone not a pensioner, allowee or low-income health care card-holder immediately before this time.

Pre 1 January 2015 accounts

These Account-based pensions will continue to have the current income test treatment apply if the recipient was receiving an eligible income support payment immediately before that day, and since that day, the person has been continuously receiving an income support payment.

This also applies to those Account-based pensions that later revert to a reversionary beneficiary on the death of the original owner, provided the reversionary beneficiary is receiving an eligible income support at the time of reversion.

Traditional annuities (such as lifetime or long term annuities) and market-linked income streams are excluded from the new rules.

Post 1 January 2015 accounts

The income test assessment will no longer relate to the gross annual nominated payment and Centrelink deductible amount. The account-based pension is deemed under the income test.

Deeming may disadvantage pensioners where the deemed income is more than the gross annual nominated payment in excess of the Centrelink deductible amount.

Who will be impacted by the proposed changes?

The extent of the impact of these changes depends on the Age pensioner’s circumstances. In some cases the application of the assets test will restrict the impact of these changes.

For those with a significant reduction in Age pension under the income test compared to the assets test, the changes may have a considerable impact. This may include those receiving:

i. A defined benefit pension from a Government super scheme

ii. An asset test-exempt or partially asset test-exempt income stream

iii. Employment or self-employment income

iv. A foreign pension

v. A disability pension from the Department of Veterans’ Affairs.

Comparing homeowners and non-homeowners

The impact of the proposed changes differentiates between homeowners and non-homeowners.

Take a single Age pensioner with $20,000 in personal use assets, $200,000 in an account-based pension and drawing a pension payment less than the Centrelink deductible amount.

Compare the Age pension entitlement under the current and new income test assessment for account-based pensions (see Figure 2).

For the homeowner, the Age pension entitlements are currently $767.15. With the new deeming rules, the Age pension entitlement would be $743.65. The homeowner doesn’t incur the full impact of deeming. The Age pension entitlement would be reduced by $23.50 per fortnight ($611 pa).

For the non-homeowner, the Age Pension entitlements are currently $808.40. With the new deeming rules, the Age pension entitlement would be $743.65. The Age pension entitlement would be reduced by $64.75 per fortnight ($1,683.50 pa).

This represents an Age pension reduction of approximately 3% for a homeowner and 8% for a non-homeowner.

What if deeming rates increase?

When and by how much deeming rates change, is at the Government’s discretion. Historically, the current deeming rates of 2.5% and 4% are quite low.

Deeming rates were as high as 4% and 6% at 16 November 2008, and the average deeming rates between 1 July 2000 and 30 June 2009 were approximately 3% and 5%.

Interestingly, deeming rates were as low as 2% and 3% immediately before 20 March 2010, at which time there was a jump to 3% and 4.5%, a considerable increase.

Any increase in deeming rates could have an adverse effect on Age pensioners with an account-based pension commenced on or after 1 January 2015.

Increasing deeming rates will lower the allowable level of deemed assets before Age pension entitlements are reduced under the income test.

Assuming no other assessable income, Figure 3 shows the current level of deemed investments a single or couple can have before their Age pension is reduced under the income test, and the impact of rising deeming rates.

Summary

Currently, pensioners have the ability to take a superannuation income stream with no or little income assessed by Centrelink.

Under the new rules to deem new income streams from 1 January 2015, an amount of income is deemed. The income test ceases to use the gross annual nominated payment and Centrelink deductible amount.

Undoubtedly, there will be Age pensioners disadvantaged – highlighted by the fact that as at 31 December 2012, 28 per cent of pensioners or 69 per cent of part-pensioners are income tested.

Over time, more Age pensioners could be impacted with increasing minimum pension payments according to age, and an inability to commute and recommence a new account-based pension to reset the deductible amount.

From 1 January 2015, any advice relating to an account-based pension must distinguish between those commenced prior or after this date.

To preserve the current income test treatment of an account based-pension, you may consider aggregating super benefits into a single account-based pension prior to 1 January 2015.

The change may present an opportunity for those drawing considerably large account-based pension payments in excess of their Centrelink deductible amount.