Kris Jenner has landed a new talk reveal that premieres on Monday, July 15 on FOX. She says it’s a life-style show that’s very current and deals with pop culture, fashion, beauty, fitness, food and celebrities. An auto of six Kardashians place into Leno, “It’s a

yeezy boost 700 dream come appropriate.” To watch a preview, adventure into YouTube.This is by far ingredients song within the The Emancipation of Mimi. It’s since it is song Do not think like to some degree. It’s boring bland and not actually Mariah’s powerful vocals in the end can keep me from falling rest when following this track.Lastly that can Coachella, may differ music festival held at Empire Polo Field, in Indio, Ca. This show are going to take place April 25th-27th. Like Lollapalooza, Coachella shares artists like Sharon Jones & The Dap Kings, The Raconteurs, Stephen Malkmus as well as the Jicks, Flogging Molly, Mark Ronson and Gogol Bordello.

“Awww just waking up in Brazil, seeing Kanye won 3 Grammy’s last night!!! That makes a total of 22!!!! That’s just so insane! Soooo proud!!!” Kim Kardashian tweeted this morning when she woke up in South america. It sounds like Kim is proud of Kanye’s accomplishments in the song industry, as she proudly shared that they had won 21 Grammy awards overall. Perhaps she will be seeing the awards typically adidas yeezy boost 350 when the two move to completed home before the particular is baby.adidas yeezy boost 350

yeezy 500 Oh, and Britney Spears won another award (she was nominated for 7), Best Pop Video, for “Womanizer.” That’s two years in a row she won the VMA for Pop Player.Echoes, Silence, Patience & Grace – Foo Fighters: This may be the sixth album for adidas yeezy boost 350 the group Foo Fighters and though their musical endeavors all tend to sound a tiny bit similar they do not don’t have any passion. A two singles from the album were “The Pretender” and “Long Path to Ruin” both of which notice the lyrics and sound great for a live Foo Fighters arena experience. The band is among of the most passionate to watch out as they croon out their tunes, not to mention they make excellent music videos. Lead singer Dave Grohl, formerly the drummer of Nirvana, will be considered memorable rock icon for your ages.

Kris Jenner has landed a new talk show premieres on Monday, July 15 on FOX. She says it’s a lifestyle show that’s very current and discusses pop culture, fashion, beauty, fitness, food and celebrities. The mother of six Kardashians place into Leno, “It’s a dream come factual.” To watch a preview, stop by YouTube.This basic far discovering song for your The Emancipation of Mimi. It’s the only song Do not think like into a degree. It’s boring bland and seriously Mariah’s powerful vocals at the end will keep me from falling to sleep when following this single.Lastly irrespective of how Coachella, the annual music festival held at Empire Polo Field, in Indio, California. This show need place April 25th-27th.

yeezy 700 wave runner Like Lollapalooza, Coachella shares artists like Sharon Jones & The Dap Kings, The Raconteurs, Stephen Malkmus and the Jicks, Flogging Molly, Mark Ronson and Gogol Bordello.

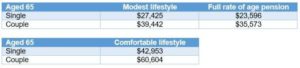

According to the Association of Superannuation Funds of Australia (ASFA) numbers, released for the September 2017 quarter, a couple will need $60,457 per annum to fund a comfortable lifestyle in retirement, assuming they own their own home and have no debt and a single person would need $44,011 per year.

So how can the income required for a comfortable retirement be funded, and how much should be put aside each year prior to retirement to accumulate the funds required to fund a comfortable retirement?

Funding a comfortable retirement

ASFA calculates that $640,000 is sufficient to fund a comfortable retirement lifestyle. Their calculations assume a couple owns their own home and will receive Government age pension support when they retire.

It is assumed that $640,000 is held in a superannuation fund and used to commence an account-based pension. However if the funds were held outside super in joint names, there wouldn’t be any significant change in the outcome, as the couple are unlikely to pay any income tax on the portfolio returns. It is also assumed that the couple’s home contents and car are valued at $25,000.

The couple, both aged 67, would only draw what they need from their superannuation account-based pension to top up their age pension income to the required level for a comfortable retirement. The level of income needed, based on ASFA’s model, decreases from approximately $60,000 per year prior to age 85, to approximately $55,000 per year – this reflects a relatively less active lifestyle as age increases.

Although their age pension entitlement is just $12,000 (approx.) per annum in the first year, that entitlement grows over time as their assets reduce – the couple become entitled to the full age pension from age 91.

This analysis indicates that the income needed could be maintained until age 99, well beyond the life expectancy of a 67 year old female (age 87.3 years) or male (age 84.6 years). The couple’s account-based pension would run out by age 101.

This outcome is sensitive to the earnings rate assumption (6.7 per cent per annum). ASFA’s assumption of 7.0 per cent per annum increases the age to which the income level can be maintained by a year, to age 100.

Other sensitive assumptions include the amount of non-financial assets ($25,000) and financial assets, for example cash holdings ($nil). These assumptions may affect the couple’s age pension entitlement, hence the amount of pension payments that need to be drawn from the account-based pension. Note that financial assets may have a net positive impact due to the additional income produced.

Saving for a comfortable retirement

Taking ASFA’s numbers ($640,000 for a couple, $545,000 for singles) as appropriate funding targets, then a natural question is:

How much should be saved each year to reach the relevant funding target?

We are focusing on a single person reaching the $545,000 (in today’s dollars) funding goal by age 67, which is the Government age pension eligibility age for those born on or after 1 January 1957.

A key feature of retirement funding for Australian employees is the compulsory superannuation contributions employers are required to make on behalf of certain employees – the Superannuation Guarantee (SG) system.

The current SG rate is 9.5 per cent of an employee’s Ordinary Time Earnings (OTE). Generally, OTE relates to ordinary hours (excluding overtime), and includes commissions, shift loadings and certain allowances. The 9.5 per cent rate will increase by 0.5 per cent per annum from 2021 to 2025, ultimately to 12 per cent.

The Average Weekly Ordinary Time Earnings (AWOTE) for the October 2017 quarter was $1,567.90 or $81,755 per year. In our modelling we have used $80,000 per year. Employees with this amount of income will have SG contributions of 9.5 per cent ($7,600 per year, paid quarterly) paid by their employer to a superannuation fund. These contributions are generally taxed at 15 per cent, so $6,460 is available to be invested by the superannuation fund each year.

Table 1 below shows that a 30 year old with earnings of $80,000 per year may accrue $536,000 in superannuation between now and retirement at age 67 from their future SG contributions alone, assuming no breaks in their employment. This amount is only slightly short of the comfortable retirement target of $545,000.

Table 1: future SG contributions accrual to age 67

| Current age |

Current Ordinary Time Earnings |

| $40,000 |

$80,000 |

$120,000 |

|

|

|

|

| |

|

|

|

| 20 |

$419,000 |

$837,000 |

$1,256,000 |

| 30 |

$268,000 |

$536,000 |

$804,000 |

| 40 |

$159,000 |

$319,000 |

$478,000 |

| 50 |

$81,000 |

$163,000 |

$244,000 |

| 60 |

$25,000 |

$51,000 |

$76,000 |

Table 2 below shows the amount the same individual in Table 1 would need to contribute to superannuation on an after-tax basis (non-concessional contributions) to reach the funding target of $545,000, assuming they have nothing in super currently. The 30 year old individual considered above would need to contribute only $124 per annum

Table 2: After-tax super contributions per annum to reach retirement goal at age 67

| Current age |

Current Ordinary Time Earnings |

| $40,000 |

$80,000 |

$120,000 |

|

|

|

|

| |

|

|

|

| 20 |

$1,109 |

– |

– |

| 30 |

$3,773 |

$124 |

– |

| 40 |

$8,723 |

$5,114 |

$1,495 |

| 50 |

$20,024 |

$16,506 |

$12,988 |

| 60 |

$64,940 |

$61,765 |

$58,587 |

These charts show that many Australians may be in a position to achieve a comfortable retirement, based on ASFA’s definition and assumptions. The Australian Superannuation Guarantee system is a significant part of achieving this outcome, which relies on the currently legislated increases in the SG rate to 12 per cent.

Before making any financial decisions you should seek personal financial advice from an Australian Financial Service licensee.

Source: Macquarie