From 1 January 2015, any new account-based pensions will be subject to deeming which may result in a reduction in the Centrelink Age Pension.

From 1 January 2015, any new account-based pensions will be subject to deeming which may result in a reduction in the Centrelink Age Pension.

Currently, only the pension payment which exceeds the account-based pension’s Centrelink deductible (or non-assessable) amount is assessable under the income test.

However, it is all about to change for all account-based pensions commenced on or after 1 January 2015.

Deeming financial investments

Most Centrelink pensions are currently subject to an income and assets test, with the amount received from Centrelink being the lowest entitlement under the two tests.

From 1 January 2015, new account-based pensions will be treated the same way as other financial assets such as cash, shares and managed funds under the social security legislation, which means they will be subject to deeming rules for both Centrelink and DVA income test purposes

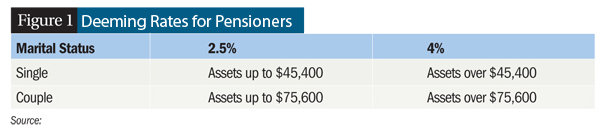

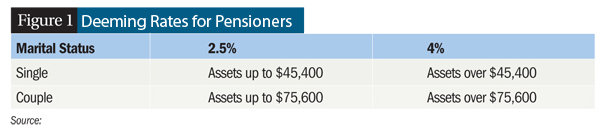

They will be deemed to earn a specified rate of return regardless of the actual returns generated. The current deeming rates for pensioners are (see Figure 1):

The impact of deeming directly relates to the applicable deeming rates. The higher the deeming rates the greater the impact. The deeming rates change at the Government’s discretion and reflect the economic environment.

Using account-based pensions to improve Centrelink Age pension entitlements

In nearly all cases, someone of at least Age pension age can commence an account-based pension and draw a pension payment equal to or lower than the Centrelink deductible amount (i.e., no assessable income under the income test).

From 1 January 2015, Account-based pensions will be categorised into:

i. Commenced pre-1 January 2015 and held by a pensioner, allowee or low-income health care card-holder immediately before this time

ii. Commenced from 1 January 2015 or those held by someone not a pensioner, allowee or low-income health care card-holder immediately before this time.

Pre 1 January 2015 accounts

These Account-based pensions will continue to have the current income test treatment apply if the recipient was receiving an eligible income support payment immediately before that day, and since that day, the person has been continuously receiving an income support payment.

This also applies to those Account-based pensions that later revert to a reversionary beneficiary on the death of the original owner, provided the reversionary beneficiary is receiving an eligible income support at the time of reversion.

Traditional annuities (such as lifetime or long term annuities) and market-linked income streams are excluded from the new rules.

Post 1 January 2015 accounts

The income test assessment will no longer relate to the gross annual nominated payment and Centrelink deductible amount. The account-based pension is deemed under the income test.

Deeming may disadvantage pensioners where the deemed income is more than the gross annual nominated payment in excess of the Centrelink deductible amount.

Who will be impacted by the proposed changes?

The extent of the impact of these changes depends on the Age pensioner’s circumstances. In some cases the application of the assets test will restrict the impact of these changes.

For those with a significant reduction in Age pension under the income test compared to the assets test, the changes may have a considerable impact. This may include those receiving:

i. A defined benefit pension from a Government super scheme

ii. An asset test-exempt or partially asset test-exempt income stream

iii. Employment or self-employment income

iv. A foreign pension

v. A disability pension from the Department of Veterans’ Affairs.

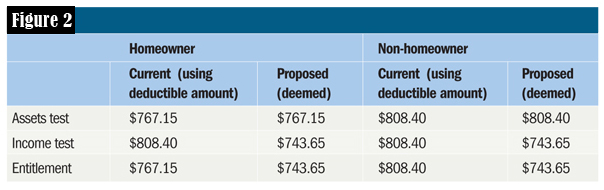

Comparing homeowners and non-homeowners

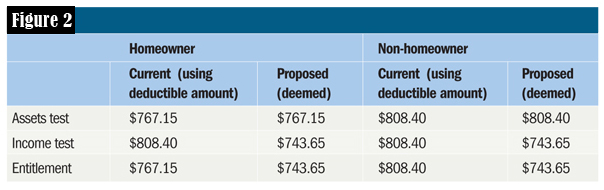

The impact of the proposed changes differentiates between homeowners and non-homeowners.

Take a single Age pensioner with $20,000 in personal use assets, $200,000 in an account-based pension and drawing a pension payment less than the Centrelink deductible amount.

Compare the Age pension entitlement under the current and new income test assessment for account-based pensions (see Figure 2).

For the homeowner, the Age pension entitlements are currently $767.15. With the new deeming rules, the Age pension entitlement would be $743.65. The homeowner doesn’t incur the full impact of deeming. The Age pension entitlement would be reduced by $23.50 per fortnight ($611 pa).

For the non-homeowner, the Age Pension entitlements are currently $808.40. With the new deeming rules, the Age pension entitlement would be $743.65. The Age pension entitlement would be reduced by $64.75 per fortnight ($1,683.50 pa).

This represents an Age pension reduction of approximately 3% for a homeowner and 8% for a non-homeowner.

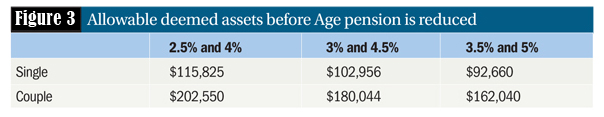

What if deeming rates increase?

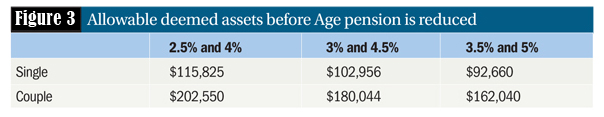

When and by how much deeming rates change, is at the Government’s discretion. Historically, the current deeming rates of 2.5% and 4% are quite low.

Deeming rates were as high as 4% and 6% at 16 November 2008, and the average deeming rates between 1 July 2000 and 30 June 2009 were approximately 3% and 5%.

Interestingly, deeming rates were as low as 2% and 3% immediately before 20 March 2010, at which time there was a jump to 3% and 4.5%, a considerable increase.

Any increase in deeming rates could have an adverse effect on Age pensioners with an account-based pension commenced on or after 1 January 2015.

Increasing deeming rates will lower the allowable level of deemed assets before Age pension entitlements are reduced under the income test.

Assuming no other assessable income, Figure 3 shows the current level of deemed investments a single or couple can have before their Age pension is reduced under the income test, and the impact of rising deeming rates.

Summary

Currently, pensioners have the ability to take a superannuation income stream with no or little income assessed by Centrelink.

Under the new rules to deem new income streams from 1 January 2015, an amount of income is deemed. The income test ceases to use the gross annual nominated payment and Centrelink deductible amount.

Undoubtedly, there will be Age pensioners disadvantaged – highlighted by the fact that as at 31 December 2012, 28 per cent of pensioners or 69 per cent of part-pensioners are income tested.

Over time, more Age pensioners could be impacted with increasing minimum pension payments according to age, and an inability to commute and recommence a new account-based pension to reset the deductible amount.

From 1 January 2015, any advice relating to an account-based pension must distinguish between those commenced prior or after this date.

To preserve the current income test treatment of an account based-pension, you may consider aggregating super benefits into a single account-based pension prior to 1 January 2015.

The change may present an opportunity for those drawing considerably large account-based pension payments in excess of their Centrelink deductible amount.