Perspective: the way you see something

Over time your perspective can change. This is influenced by numerous factors including age, education, your varied life experiences, family, a circle of friends, and no doubt – travel.

I myself am a good example of changing my perspective over time. Especially if I recount my own personal experiences from the last couple of months.

I have just returned from holidays in France and Italy. Before I left on my holiday people were very kind in offering suggestions of what to see, what not to see, what to be careful of, who to be careful of, where to eat, and where to stay.

So before I had even left the country I was concerned about the attitude of the French, gypsies begging in the street, pickpockets, crowds and queues, my own security, terrorists, and the scorching heat of a European summer. My perspective had been altered and I asked myself, “have I made the right decision to go to France and Italy for my holidays?”

The tragedy that occurred in Nice just before I arrived did not help the situation.

After three weeks travelling through France and Italy, I can report that the people I met in France were very polite and helpful, I did see a number of people begging, but was never harassed by any. The crowds and queues can be significant but if you get up early the problem is reduced. It was warm but not unbearable, and security measures were visible in most places so I never felt overly concerned for my own safety.

My perspective had changed once again and was in a very positive mindset regarding my attitude to travel.

However, it did make me realise that the negative comments I had read or listened to prior to my holiday had altered my perspective, and made me question my decision to take holidays in France and Italy. I had, in fact, provoked my own degree of fear.

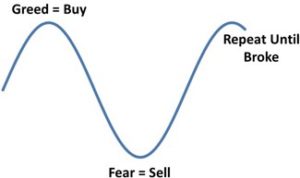

So my question now is with all the negative press regarding ‘longevity risk’ in retirement, do we run the risk of altering people’s perspective of retirement to one of fear and trepidation?

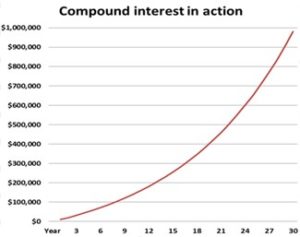

I do understand that longevity risk is a concern. But have we tipped the scales too far to the point where people are now over-concerned about spending too much money early in their retirement, and trying too hard to adjust spending patterns to ensure they are able to continue to fund their retirement when they do reach their late 80s?

There is no doubt a fine line that a person needs to tread between an appropriate level of spending and saving in retirement. After a recent meeting with older retirees in nursing homes (whose health now precludes them from doing much more than sitting and watching television), a common theme emerged – a regret of not doing a lot more when they were healthy and able.

Yes, I can hear you say ‘hindsight’ is a wonderful thing, and is a great foundation for making a decision but of course never a reality.

Now, I am certainly not saying that when people retire that they should go on a spending spree. But if a person’s perspective of retirement has been tainted by the looming negativity around ‘longevity risk’ and face retirement with a degree of fear and trepidation as an industry, have we now taken all the fun and anticipation out of a person’s pending retirement?

Retirement, as I have often stated, is a lot more than just ensuring a person has enough cash to fund their lifestyle. Let us make sure that when a person is planning their retirement that they do take a more holistic approach and consider their health, their objectives or goals, and their attitude – as well as their need for wealth. Let us make a person’s retirement a time to treasure which is full of memories, so when they are too old to do much more than sit and watch they do so without regrets.

Source: Mark Teale – Centrepoint Alliance