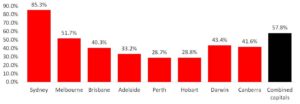

In the 2017 Budget, the Government announced several measures designed to ease the pressure on spiralling housing prices, particularly in the East Coast capital cities of Melbourne, Sydney and to a lesser degree, Brisbane.

I will provide an update on two of the key measures contained in the 2017 Budget.

On 7 September, the Government tabled a Bill in the House of Representatives covering its first two measures.

- The First Home Savers Super Scheme (FHSSS)

This initiative is designed to allow intending first home buyers to save for their home deposit through superannuation and then withdraw the savings when the time comes to buy.

A broad outline of the scheme will allow additional contributions of up to $15,000 to be made each year with the maximum amount that may be withdrawn being $30,000 plus investment earnings. For a couple, multiply this by two.

Contributions may be concessional contributions, such as those made under a salary sacrifice arrangement or personal contributions where a tax deduction has been claimed. Or, they may be non-concessional contributions made from after-tax income. All contributions made under the scheme are subject to the usual contribution caps.

Contributions made by an employer in fulfilling their superannuation guarantee obligations – the 9.5% contribution – cannot be withdrawn under the scheme. Only voluntary contributions may be withdrawn.

The FHSSS came into effect on 1 July 2017, however, at the time of writing, the legislation has not been passed by the Parliament.

With that is mind, it might be prudent to wait until there is legislative certainty before making additional voluntary contributions that may be required for a home deposit.

Whether the FHSSS is an appropriate strategy will be very much dependent on individual circumstances. Some appropriate advice, before putting extra money into super, is vitally important.

- Downsizer Contributions

In an attempt to free up housing that is currently occupied by older Australians, the Government has introduced legislation that will enable people aged 65 and over, who have owned their home for at least 10 years, to contribute up to $300,000 of the sale proceeds of their home to superannuation as a non-concessional contribution.

These contributions will not be subject to the usual restrictions that apply to making non-concessional contributions.

Once legislated, this initiative is due to come into effect from 1 July 2018. It will only apply to home sales occurring on or after that date.

Whether this measure will make a meaningful difference to the supply of housing is questionable.

One of my biggest concerns is that the primary residence is currently exempt from the assets and income tests for the age and Veterans Affairs pensions. With a very high proportion of older Australians receiving either a part or a full pension, the implications of downsizing could be significant.

Selling the family home and investing any surplus proceeds from the sale into superannuation, or most other types of investment will see money that was previously exempt from means testing now being caught under the assets and income test.

In fact, a couple of modest means who own a valuable home could lose their age pension entirely if they sold their family home and contributed $300,000 each to superannuation as a non-concessional contribution.

However, contributing the surplus proceeds from the sale of a family home, to super will be quite appropriate for some.

Like so many of these initiatives that at first glance seem very attractive, the devil lies in the detail. Whether selling the family home and downsizing simply to get more money into super is an appropriate strategy, will depend on individual circumstances.

Source: Peter Kelly | Centrepoint Alliance